Due to the massive outbreak of the COVID-19, the relations and the equations between all the finance backgrounds have changed majorly, without people realizing what is happening actually.

Everything happened at a pace that no one actually realized what exactly went wrong or what could be done to make things better. However, amidst all odds people expected the bitcoin market to not change but now it has been affected.

If you want to know how to trade bitcoin then no one better than Bitcoin LifeStyle software would be able to explain to you how the system works. Right from today starts thinking about how can you invest in it. And here Taxfyle.com can help you.

Recommended: Best Cryptocurrency Apps for iOS and Android

Why Bitcoin is Compared to Gold?

The physical gold metal has failed to give security to the investors which hs led the businessmen, the bankers, and the investors to rely on the digital gold that is the bitcoin. The short term economic despair, people have lost all hope on gold, as the gold prices are also declining, something that seems relatively less affected is the bitcoin business, not every bitcoin value has devalued.

As we all know that there is a certain relation between the gold and all other economic factors that have been affected largely due to this coronavirus and the hope of a developing situation seems very less. This time, it has been taken a note that all the sectors might work separately but each of them is relevant or interdependent on each other. If one of the sectors goes through depression, automatically all the other would automatically go through problems.

Recommended: Gold Market Review

Relation of Bitcoin and All Other Assets

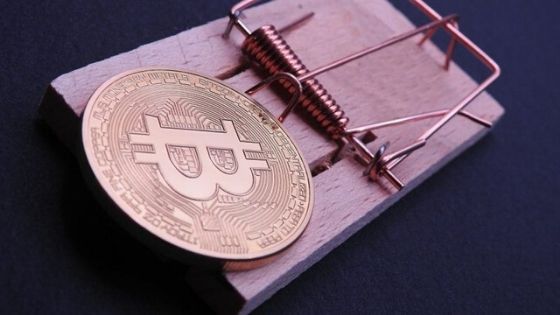

When the bitcoins or the real digital gold came into the test, it seemed that the tables turned around and the picture became clear. Many had overestimated the power of bitcoin, the reality specks check came into view with what really happened to bitcoins during COVID-19. Till 2019, the bitcoins were known as “Safe Haven” Unless it was put under the measure of being tested during the coronavirus pandemic and the myth was broken.

Many studies of relations have shown that now the digital currency, bitcoin is related to many of the assets that people buy these days as investments. Till before this, the bitcoins have always been a rescue and a sign of relief whenever there has been crisis. Bitcoins never faced as low importance as it faced in these few days as if the entire financial globe wanted the bitcoins to work but it failed.

Portfolio of An Investor

Every investor has a portfolio of their own, which has to be followed and updated every time they make new investment and this helps them to keep a track of how much investments they have done and where all they have made these investments. The major risk that an investor face is the risk of assets on which they invest.

Every asset is related to each other and they can’t retain the value if they are treated as individuals. They have to be all treated as an asset. In this case, having a manager becomes very important who would keep a track of what and when and how much should be invested to get back a proper profit.

The portfolio managers manage the portfolio properly without brining too much on the platter for you to solve except asking for your permission.

Conclusion

In spite of such a disappointment, it would be wise not to lose any hope from the bitcoins. The bitcoins keep the ability to raise the price of the bitcoins will rise and only bitcoins have this capacity to rise anytime from the downfall.

Related Post: